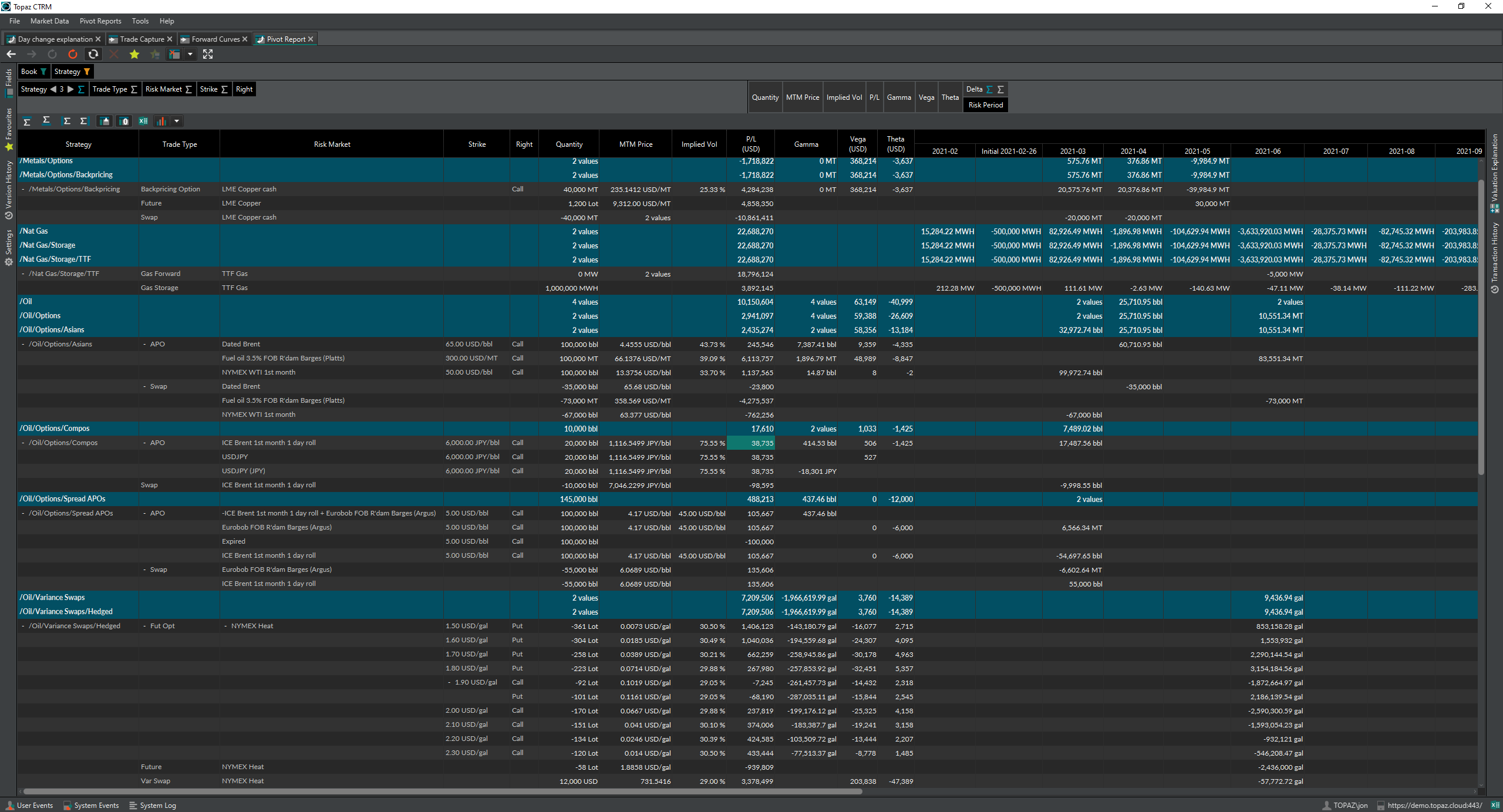

- Cross-commodity exotic options such as cargo spread options, backpricing options, barrier options, quantos, compos and many more

- Storage modelling

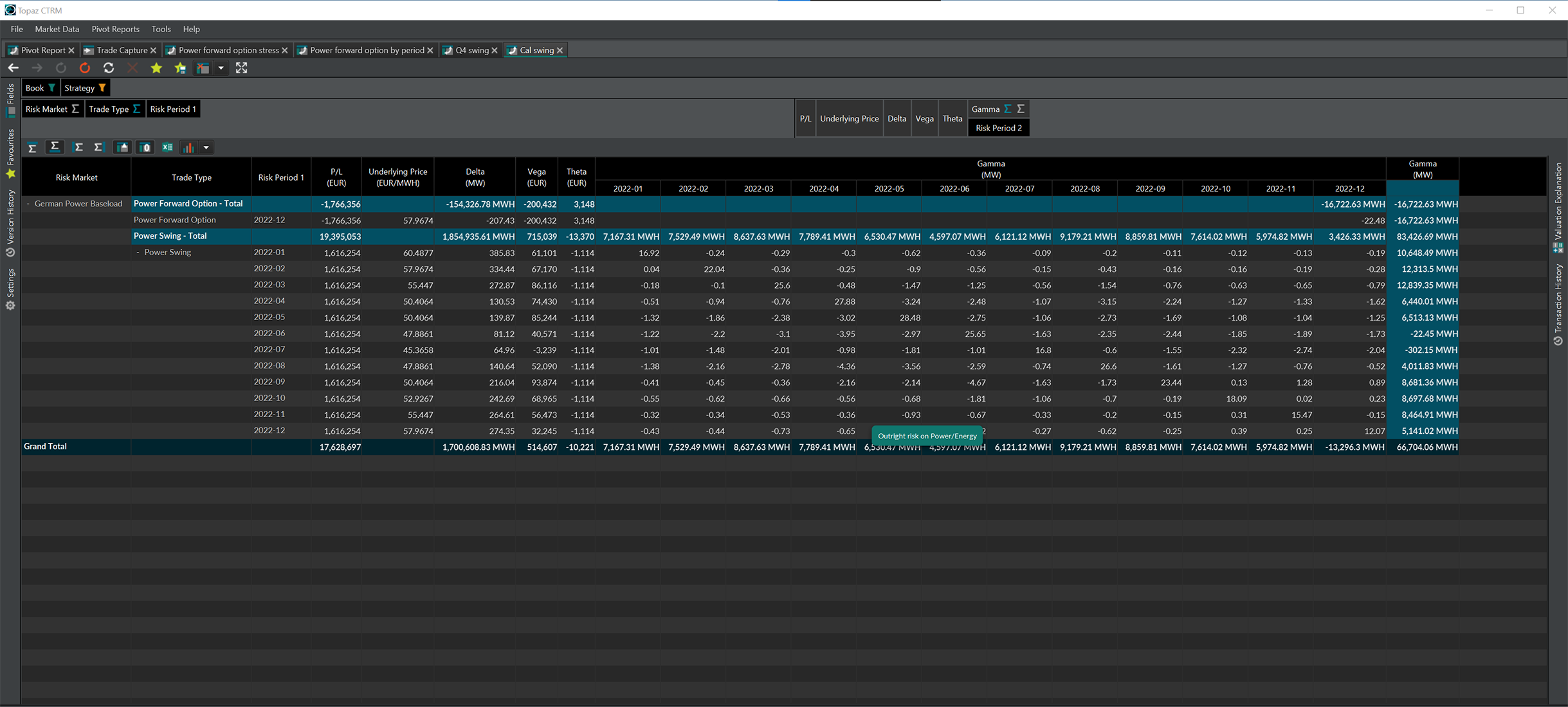

- Swing and spark spread options

- Variance swaps

- Parametric and Monte Carlo VaR

- Stress testing by prices, vols, and time

- Distributed framework for Monte Carlo and Longstaff-Schwarz methods

- Variety of options models covered; new models continually being added

- Real-time mark-to-market valuation and P&L calculation, at any level across multiple portfolios with any combination of trade types

- Wide range of options models available such as Black Scholes Merton, Bachelier, Reiner Rubenstein, Turnbull-Wakeman, Binomial / Trinomial Trees, Vorst, Curran, Crank-Nicholson and others

- New models continually added

- Valuation Explanation - our unique feature shows you exactly how we have calculated each valuation, so you can easily reconcile or troubleshoot

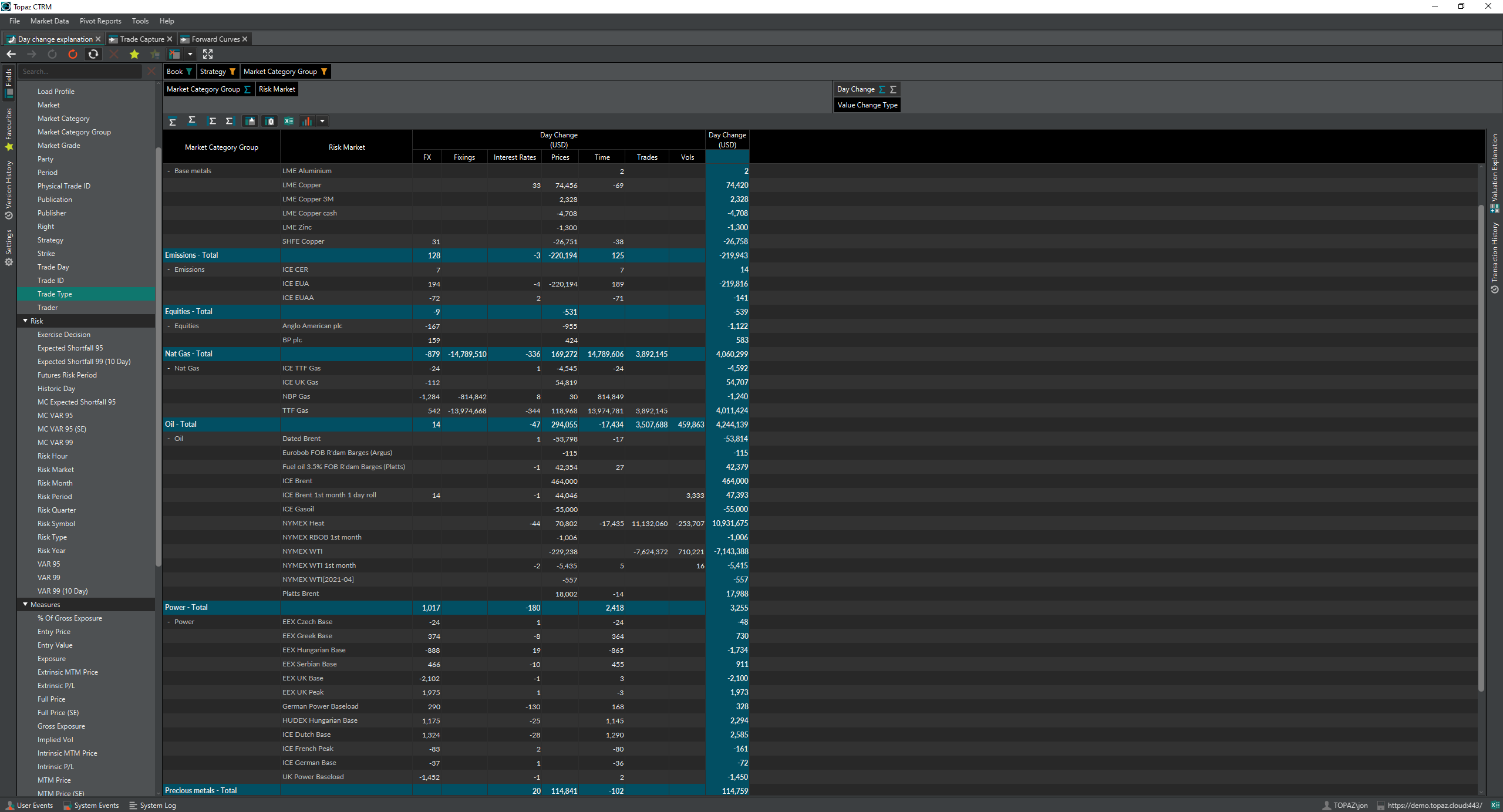

- Full P&L Change Explanation, broken out by market data such as forward curves, fixings, vols, FX rates, and more, along with trade amendments

- Real-time exposure calculation at any level across multiple portfolios

- All greeks and other analytics calculated in real-time at any level across multiple portfolios

- Parametric and Monte Carlo VaR; distributed framework for fast calculation for large trade volumes

- Price, volatility and time stress testing

- Flexible reporting, including full customisation of reports with multiple metrics and data broken out in multiple ways

- Comprehensive drill down for more granular reporting

- Every report can be charted and exported to Excel

- All data is fully versioned and all reports can be run historically

- Instantaneous close of book functionality for end of day reports

- Provides consolidated view of risk across multiple commodities and regions

- Well designed OpenAPI and gRPC APIs (Application Programming Interface) for easy integration

- Excel add-in trade blotter

- Trade feeds via STP (CME and ICE)

- Trade feeds from internal systems via the Topaz API

- Market data uploads via Excel or from other systems via the Topaz API

- Live reporting feed into Excel for real-time custom analysis