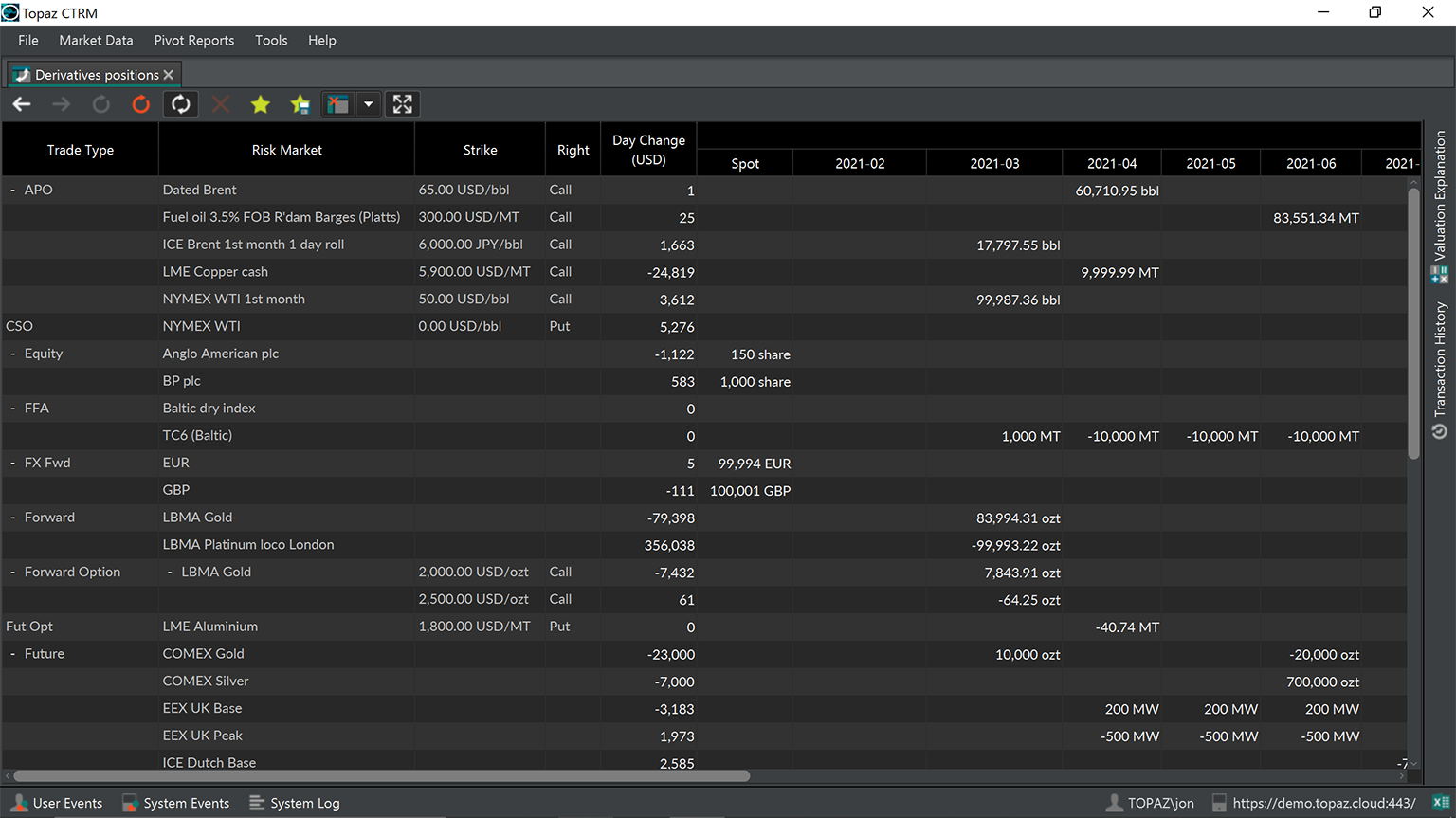

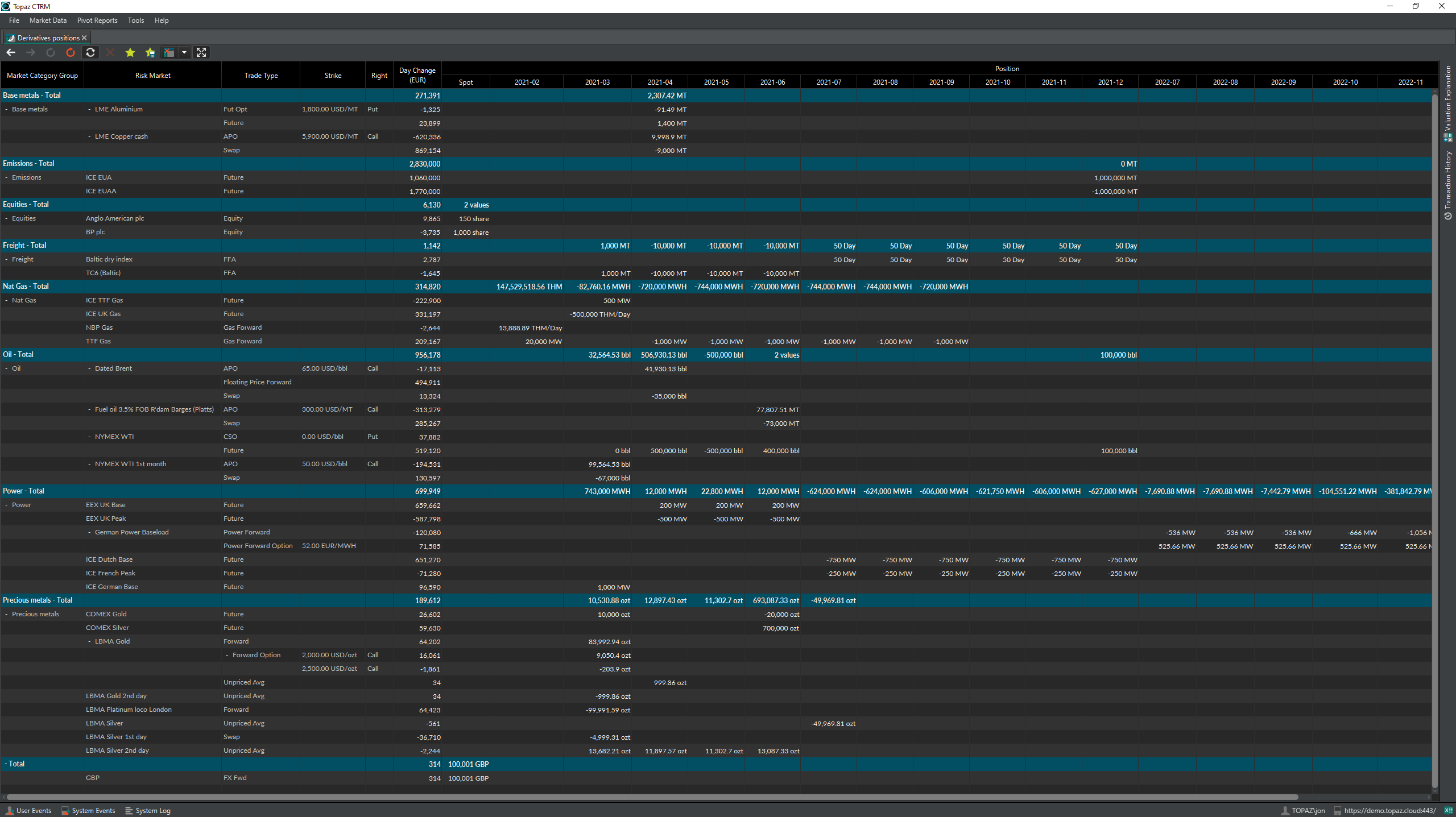

- Cross-commodity derivatives including oil, base and precious metals, gas, power, softs, iron ore, coal, chemicals, and freight

- Futures, swaps, forwards, and FFAs (wet, dry, TCA)

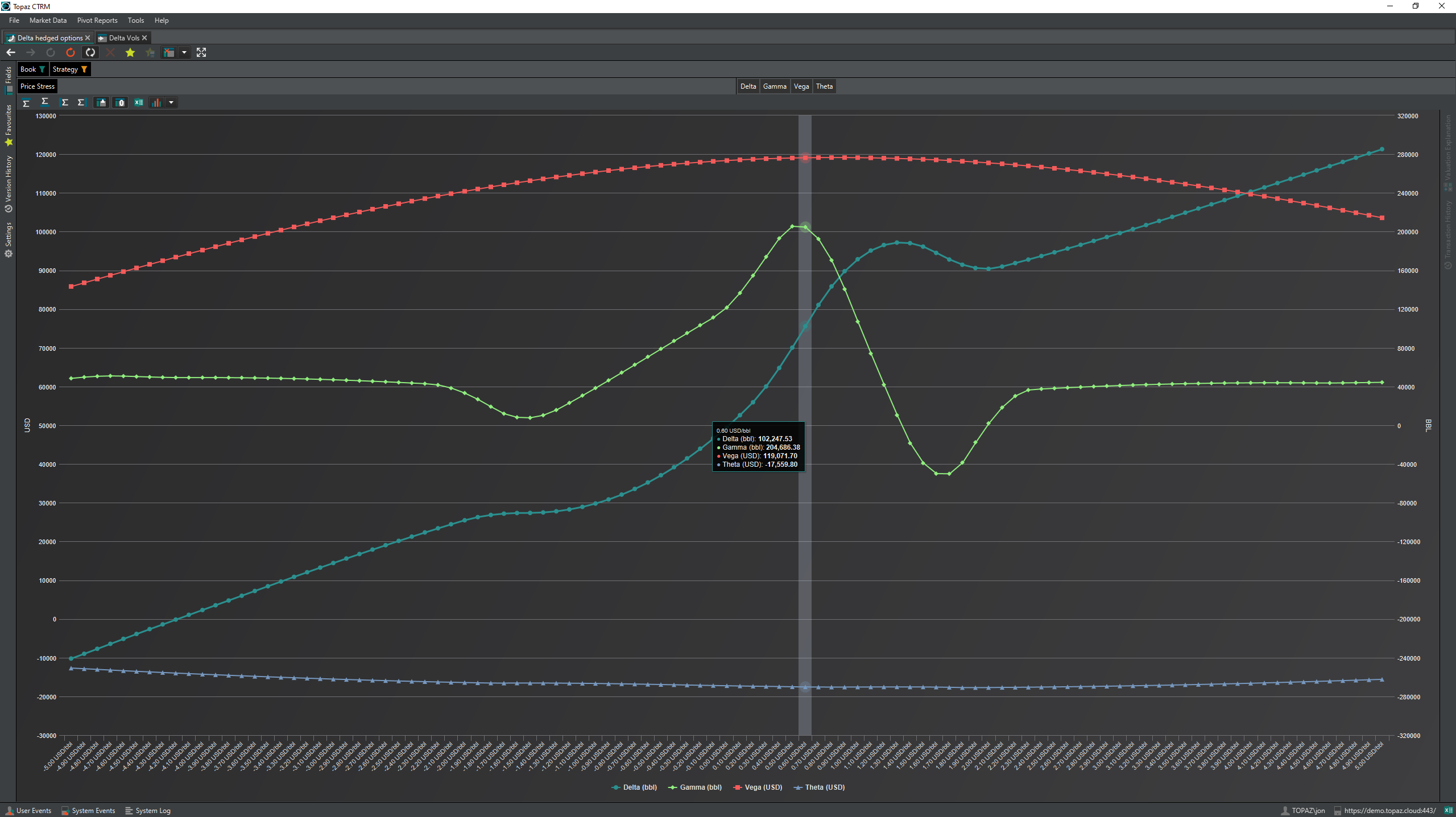

- Vanilla options, asians, swaptions, spot options, CSOs, spread options*

- FX forwards and options

- Fixed income including interest rate swaps and futures, FRAs

- Equities

- Full multi-currency support

- * See our Advanced Analytics module for further option types.

- Real-time valuation and P&L calculation, at any level across multiple portfolios

- Speed and scalability, even for large trade volumes

- Full cashflow discounting framework

- Excel add-in functions for pricing sheets using system models and market data

- Valuation Explanation - our unique feature shows you exactly how we have calculated each valuation, so you can easily reconcile or troubleshoot

- Full P&L Change Explanation, broken out by market data such as forward curves, fixings, vols, FX rates, and more, along with trade amendments

- NaturalState™ Representation: All data is stored in its natural form including the original units, which provides the basis for our accurate units conversions

- Real-time exposure calculation at any level across multiple portfolios

- All greeks including diffs and bleeds calculated in real-time at any level across multiple portfolios

- View exposures broken down by different time granularities from hours all the way to years, and mix granularities in the same report

- Easily view all exposures converted into consistent units

- Intrinsic and extrinsic options prices and values

- Flexible reporting, including full customisation of reports with multiple metrics and data broken out in multiple ways

- Comprehensive drill down for detailed reporting on subsets of data

- Every report can be charted or exported to Excel

- All data is fully versioned and all reports can be run historically

- Instantaneous close of book functionality for end of day reports

- Well designed OpenAPI and gRPC APIs (Application Programming Interface) for easy integration

- Excel add-in trade blotter

- Trade feeds via STP (CME and ICE)

- Trade feeds from internal systems via the Topaz API

- Market data uploads via Excel or from other systems via the Topaz API

- Live reporting feed into Excel for real-time custom analysis